Description

Speakers:

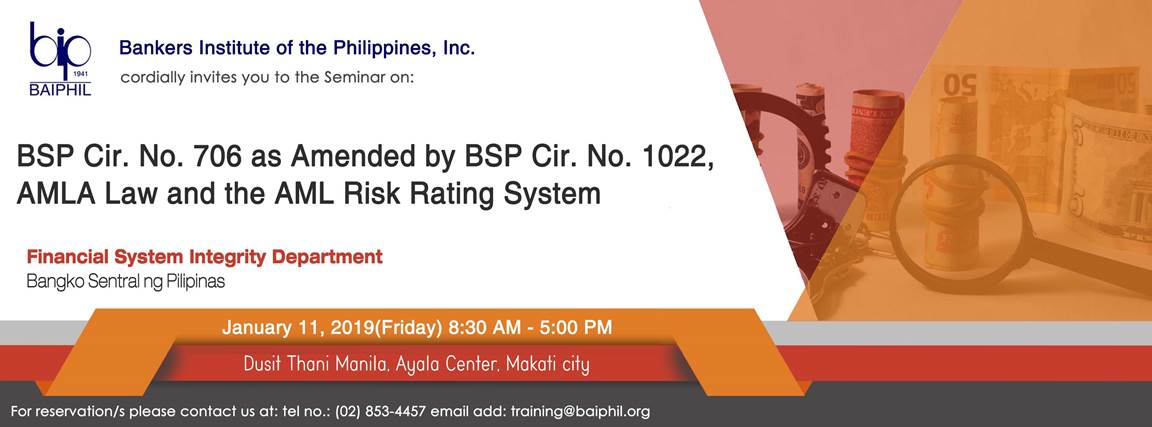

Financial System Integrity Department, Bangko Sentral ng Pilipinas

Course Outline:

I. Philippine Regulatory Framework (RA 9160; RA 10167; RA 10168; RA 10365)

a. What is Money Laundering

b. What is Money Laundering Offenses, parties involved and penalties

c. Unlawful Activities/Predicate Crimes

d. Highlights of Revised RIRR on AMLA

II. BSP Circular No. 706 as Amended by BSP Cir. No. 1022

a. AML Risk Management

b. Customer Identification Process (Customer Acceptance [i.e, PEP,

FX Dealer/Money Changer/RA/Pawnshop; Prohibited Accounts], Due

Diligence, Risk Profiling, On-going Monitoring)

c. CT/ST Reporting/ including Red Flags

d. Record Keeping

e. Common Deficiencies noted during BSP Examination

f. Amendments to Circular No. 706.

III. Overview of the AML Risk Rating System

IV. Question and Answer

V. Case Study

Schedules and Venue:

January 11, 2019 (Friday); 8:30 A.M. to 5:00 P.M. –

Dusit Thani Manila, Ayala Center, Makati City